Loan

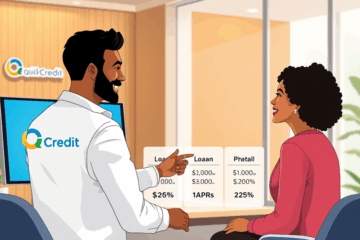

Fast Secure Credit for Real Estate Refinancing

Secure Credit plays a vital role in today’s real estate market, particularly for homeowners seeking efficient mortgage solutions. This article delves into the advantages of Quick and Secure Credit for Real Estate Refinancing, highlighting how homeowners can benefit from swift refinancing processes, reduced interest rates, and diverse tailored options. We’ll Read more…